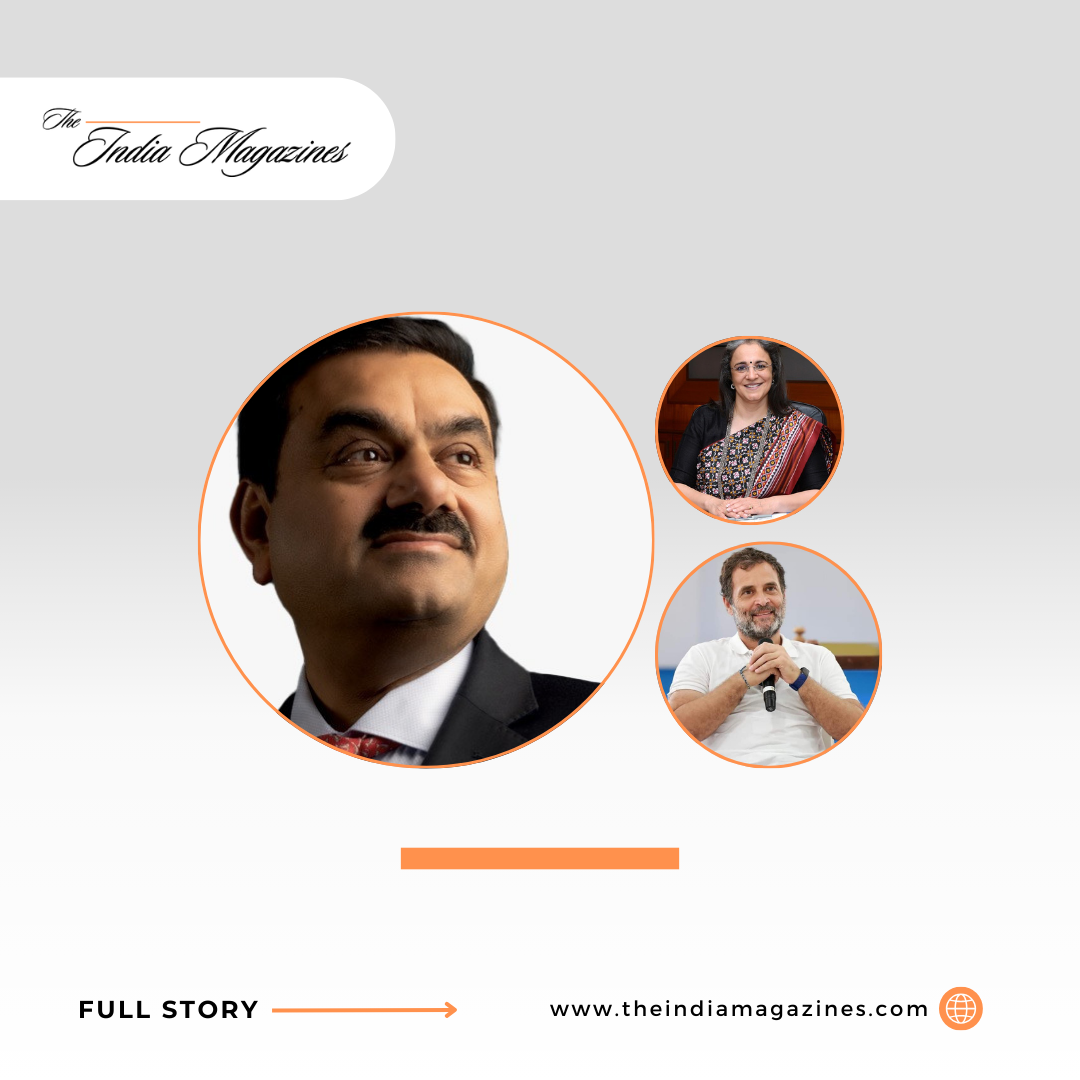

Congress leader Rahul Gandhi recently expressed concerns about the safety of millions of Indians’ hard-earned savings following the allegations made by the Hindenburg Report against SEBI Chairperson Madhabi Puri Buch for allegedly not acting against the Adani conglomerate. Rahul Gandhi’s remarks have sparked controversy, especially given his personal financial gains from the stock market.

In a video message shared on social media platform X on August 11th, Rahul Gandhi accused the Indian stock market regulator, SEBI, of being compromised, likening the situation to a cricket match where the umpire is biased. He emphasized that a significant portion of Indians’ savings, which are invested in the stock market, are at risk due to the alleged corruption within SEBI. Gandhi’s remarks were aimed at both SEBI Chairperson Madhabi Puri Buch and the Adani Group, with the Congress leader suggesting that SEBI had failed to act on illegal share ownership and stock manipulation accusations against the conglomerate.

Ironically, these statements come on the heels of a report by IANS revealing that Rahul Gandhi himself has profited handsomely from the stock market. Over the last five months, Gandhi’s stock market portfolio grew from approximately Rs 4.33 crore on March 15, 2024, to nearly Rs 4.80 crore by August 12, 2024, netting him a profit of Rs 46.49 lakh. His portfolio includes major stocks such as Asian Paints, Bajaj Finance, Infosys, and TCS, with 20 out of his 24 stocks being profitable.

The integrity of SEBI, the securities regulator entrusted with safeguarding the wealth of small retail investors, has been gravely compromised by the allegations against its Chairperson.

Honest investors across the country have pressing questions for the government:

– Why… pic.twitter.com/vZlEl8Qb4b

— Rahul Gandhi (@RahulGandhi) August 11, 2024

Critics have pointed out the contradiction between Gandhi’s fearmongering about the stock market and his own financial gains from the same market. His assertions about the risks faced by ordinary investors have been viewed as an attempt to paint himself as a champion of the common man while benefiting from the very system he criticizes.

This isn’t the first time Rahul Gandhi has targeted the Adani Group and SEBI. His attacks on Gautam Adani and the Modi government have been persistent, often based on reports by foreign entities like Hindenburg Research. Despite the Supreme Court giving a clean chit to the Adani Group, finding no malpractice or regulatory failure, Gandhi continues to use these allegations to question the integrity of both the Adani Group and the Indian government.

Gandhi’s rhetoric has often portrayed India’s economic growth as fragile and at risk, a narrative that contrasts sharply with the ongoing economic progress and the stock market’s resilience. His focus on alleged crony capitalism and wealth concentration in the hands of a few has been a key part of his political strategy, particularly ahead of elections. However, his own financial success in the stock market raises questions about the sincerity and consistency of his position.

Moreover, the Congress party’s contradictory actions, such as the Telangana government signing Memorandums of Understanding (MoUs) worth Rs 12,400 crore with the Adani Group earlier this year, further complicate Gandhi’s narrative. If the Adani Group is indeed as compromised as Gandhi suggests, why does the Congress-led government in Telangana continue to engage with them?

The Indian stock market, despite the initial setbacks following the Hindenburg Report, has continued its upward trajectory, reflecting the confidence of Indian investors. SEBI, in its response, has urged investors to remain calm and conduct thorough research before reacting to the allegations made by the US-based short seller. SEBI refuted the accusations, emphasizing that the claims had been duly investigated.

Rahul Gandhi’s continued reliance on such reports, despite the market’s stability and his personal gains, may backfire, potentially alienating both the business sector and ordinary citizens who benefit from a strong economy. His approach risks creating unnecessary fear and uncertainty, undermining the very economic growth he claims to defend. As the Indian market remains robust, Gandhi’s contradictory stance highlights the complexities and potential pitfalls of his political strategy.